What is a Credit Score?

A credit score is a 3-digit number that helps lenders predict how likely you are to make payments on time. Most scores range from 300-850. A high score usually makes it easier to qualify for a credit card or loan and may result in a better interest rate. Scores are produced by companies like FICO (Fair Isaac Corporation) and VantageScore. These companies use a mathematical formula called a scoring model or credit-score model to create your score. Scoring models use information from your credit report to create your personal credit score. Credit scoring companies research credit reports provided by credit monitoring agencies. In the U.S. there are three major credit bureaus that provide your information to score.

Credit Bureaus:

- TransUnion

- Equifax

- Experian

A credit bureau collects and analyses individual credit information and sells it to creditors for a fee, so they can make decisions about granting loans or credit. The top three credit bureaus in the U.S. are listed above, although there are several others. Credit bureaus get data from your creditors, such as a credit card lender, bank, or any finance company. They also get information about you from public records, such as property and court records. Some lenders may only report to one bureau or none. When in doubt ask if they report to all three credit bureaus.

Three Credit Scores

You do not have just one credit score, but three. Each credit bureau produces a credit report that can be calculated into a score. Each score individually may vary depending on who reported to them and when.

Scoring Models

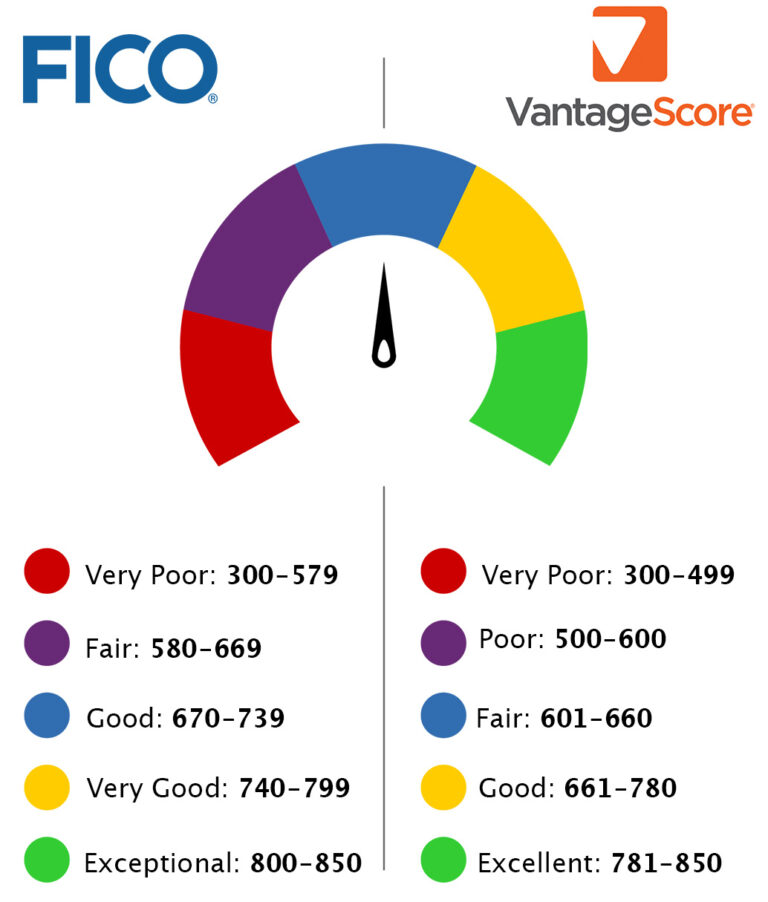

Scoring models grade slightly different from each other so having a different score for each is common; especially while you are building your credit. VantageScore has been growing rapidly in but, FICO score is used by 90% of lenders checking your credit. Typically, a score of 750+ sees no significant difference in perks than one with an 850 score.

6 Factors that make up a typical credit score include:

- Your payment history – How much of your payments are made on time.

- Your credit utilization – How much of your available credit you are using.

- Average Credit Age – How long have you had each account.

- Total Accounts/Mixed Accounts

- Hard Inquiries/New Credit

- Derogatory Marks – If you have had a debt sent to collection, a bankruptcy, or a foreclosure, and how long ago.

Lenders use credit scores to make informed decisions such as whether to offer you a credit card, auto loan, mortgage, rent, or even a job. They are also used to determine the credit limit, and the interest rate you receive on a loan or credit card.

Keep in mind there is more than just one score and the credit-score depend on the data used to calculate it, and may differ depending on the scoring model, the source of your credit history, the type of loan, and even when it was calculated.